Tax Connect Online

E-file, online tax return payment and account inquiry.

File your Maumee tax return online -- Maumee tax filers with w-2 (s), 1099(s), Schedule C, E OR F may file online.

Maumee taxpayers may pay online.

File your Maumee tax return online -- Maumee tax filers with w-2 (s), 1099(s), Schedule C, E OR F may file online.

Maumee taxpayers may pay online.

Mandatory Estimated Tax Payments

The payment of quarterly estimated taxes is mandatory for any taxpayer that expects to owe $200 or more for the tax year. Failure to pay quarterly estimated tax payments will result in a late payment penalty of 15% of the amount not timely paid plus the current calendar year interest rate (See Interest Rate Chart under Forms & Reports). Quarterly estimated tax payments are due on April 15th, June 15th, September 15th and January 15th of each year. Maumee quarterly estimated tax forms and instructions can be obtained in the links at the bottom of this page, by email at tax@maumee.org or by calling our office at 419-897-7120.

When & Where to File Return, Assistance, Forms

The return is to be filed on or before April 15 or the IRS Due Date, if you are on a calendar year basis. If you are on a fiscal year basis it is due the fifteenth day of the fourth month after the end of the fiscal year. Make checks payable to Commissioner of Taxation. Payments shall be allocated first to penalties due, then to interest due and then to taxes due. Mail your completed return to: Division of Taxation, City of Maumee, 400 Conant Street, Maumee, OH 43537-3300. Taxpayer assistance is available at our office or by calling (419) 897-7120 between 8 - 4:30 weekdays. Our e-mail address is tax@maumee.org.

Extension of Time for Filing Returns

A copy of the Federal extension is required on or before the original due date of the Maumee return. Statutory interest will be charged from the original due date of the return until date of actual payment.

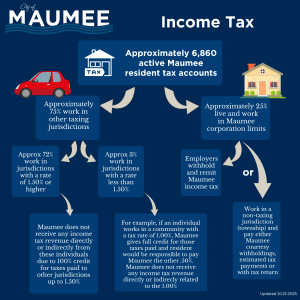

Who is Required to File?

You must file a City of Maumee Income Tax Return, whether or not there is tax due, if: you are a resident of Maumee; a non-resident who derives income within the City of Maumee on which no tax is withheld; a resident or non-resident business entity (individual, partnership, corporation, LLC, etc.) who conducts business within the City of Maumee or who has net profits derived from sales made, work done, services performed or rendered or other activities conducted in Maumee.

Income Subject to the Tax

Residents must report all income, including but not limited to sources listed below, whether received as cash or other property, including income derived from sources outside the City of Maumee and/or outside the State of Ohio, from all wages, salaries, bonuses, commissions, fees, tips; profits and/or loss from businesses, professions, partnerships, Sub S corps, LLC's or similar business entitles; winnings from lotteries or wagers; rents in excess of $100.00 per month; cost of group term life insurance over $50,000.00, sick pay, employer supplemental benefits (SUB pay) and employee contributions to retirement plans.

What Constitutes Net Profit?

Net profit of any business entity is the same as reported to IRS with adjustments for Maumee for the requirements of the Ordinance and Regulations and rulings of the Commissioner.

The Following are not Deductible in Determining Net Profits for Maumee Income Tax Purposes

- ❌ Municipal, Federal or State Income Taxes.

- ❌ Gift, Estate or Inheritance Taxes.

- ❌ Taxes for local benefits or improvements to property which tend to increase its value.

- ❌ Taxes on property producing income not taxable by the Municipal Income Tax Ordinance.

- ❌ The Federal Investment Credit.

- ❌ Loss on the sale, exchange, or other disposition of depreciable property used in the taxpayer's business.

TAX FORMS AND INSTRUCTIONS

Individual / Business Net Profit Forms

MMT JEDZ Net Profit Forms

Employer Withholding Forms

General Forms & Information

If you have additional questions regarding Maumee income tax, please call 419-897-7120